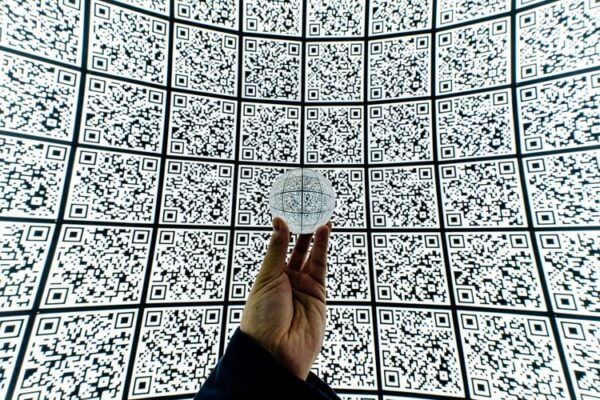

How to obtain Barcodes for your Products Barcodes may now be seen on the packaging of a wide range of items, and they serve a variety of vital functions. If... read more →

Filing business taxes, particularly for new entrepreneurs, can be a time-consuming and difficult procedure. Small company owners must be well-versed in the federal, state, and local taxes that must be... read more →

The significance of developing a strong brand cannot be overlooked. If you're planning to launch any kind of product or service, your brand is the most important thing to consider.... read more →

National Food Safety Card Objective A legal document allowing cardholders to obtain commodities such as rice, sugar, fertilizers, kerosene, and LPG at a subsidized price is the Food Safety Card,... read more →

The Goods and Service Tax (GST) is an indirect tax placed on the supply of goods and services based on their destination. Many indirect taxes, such as VAT, service tax,... read more →

Working to raise a small company's value is commonly an element of one's business plan. Value is critical whether we're looking to fund present expansion, sell a business in the... read more →

There is a lot of debate about social media, much of it is of less use. Networking neophytes promote myths about how and why to use these networks. So here... read more →

in this article, we are going to discuss the fundamentals of GST in India. The Goods and Services Tax (GST) is an indirect tax in India that has replaced numerous... read more →

MSME (Micro, Small and Medium Enterprises) MSME sector in India is the second-largest sector after agriculture that has evolved as a vibrant and dynamic sector of the country’s economy over... read more →

The principle justification for a company to register itself as a Section 8 Company is to develop non-profit objectives. The objective is to include Trades, business, arts, charity, education, religion,... read more →